On the third Tuesday of September, the Dutch government announced the Tax Plan 2023. In it, the government proposes a series of tax measures to the House of Representatives and the Senate for approval. They will vote on it on Thursday 10 November 2022.

The first part of this article explains a selection of measures that can have an impact on entrepreneurs with a BV. The tax measures that are more related to income tax and entrepreneurs with a sole proprietorship or VOF can be at the end of this article.

Corporate income tax increase

The Tax Plan describes two adjustments to the corporate tax rate that will mainly affect small and medium-sized enterprises. It is proposed to increase the low rate from 15% to 19% from 2023. In addition, the bracket to which the low corporate tax rate applies will be reduced from €395,000 to €200,000. Everything above is taxed in the second bracket at 25.8% corporate tax.

Rate adjustment box 2

The income that a shareholder with a substantial interest (at least 5% of shares) receives from a BV is taxed with a 26.9% levy on substantial interest. This applies to, for example, dividends and the sales profit over a transfer of the shares.

The Tax Plan 2023 proposes to divide the box 2 rate into two brackets, as of 1 January 2024. Up to € 67,000 the rate is 24.5%, above that amount the rate is 31%. This will encourage an annual payout of dividends.

Adjustments to the minimum director’s salary

Based on the minimum director’s salary regulation, a director and major shareholder (DGA) must receive a certain customary salary. This wage must, at least, be set at the highest of the following three amounts:

- € 48.000

- The salary of the highest earning employee

- 75% of the salary from the most comparable employment

Cancel efficiency criterion

When applying the main rule, the wage may be reduced by the so-called efficiency criterion of 25%. It is proposed to delete this efficiency criterion, as a result of which the usual wage must in many cases be set higher. This measure will be added to the Tax Plan 2023 by means of a memorandum of amendment.

Expired exception innovation startups

At this moment, an exception applies to innovative start-ups: their wage can be set lower, to at least the statutory minimum wage. This exception will expire after 1 January 2023. Due to a transitional measure, the exception will continue to apply for the remainder of the term for DGAs who already use it.

Maximization 30% ruling

Under certain conditions, the 30% ruling (or 30% tax facility) is applied to the wages of employees with specific expertise who have been recruited from abroad. These employees receive a substantially higher net salary.

It is proposed to limit the salary to which the scheme is applicable as of 1 January 2024, and to maximize it at the standard determined in the Standards for Remuneration Act (‘Wnt‘). This standard, popularly referred to as the Balkenende standard in the Netherlands, has been set at € 216,000 in 2022.

Work-related costs scheme: discretionary scope

Within the discretionary scope of the work-related costs scheme, tax-free allowances can be provided to employees, such as gifts or a staff party. This discretionary scope can also be paid out as a tax-free bonus. As of 1 January 2023, the discretionary scope will be expanded from 1.7% of a wage bill of € 400,000 to 1.92% of a wage bill of € 400,000.

Work expense allowance: tax-free allowances

In addition, an employer can provide certain allowances. The tax-free travel allowance will be increased from € 0.19 to € 0.21 per kilometre. A further increase to € 0.22 is proposed from 2024. Earlier reports have also indicated that the tax-free home working allowance will be indexed and thus increased from € 2 to € 2.13 per day as of 1 January 2023.

The entire Tax Plan 2023 and all other measures can be found (in Dutch) on the website of the Dutch government.

Things you need to know as a freelancer

Phasing out the private business ownership allowance

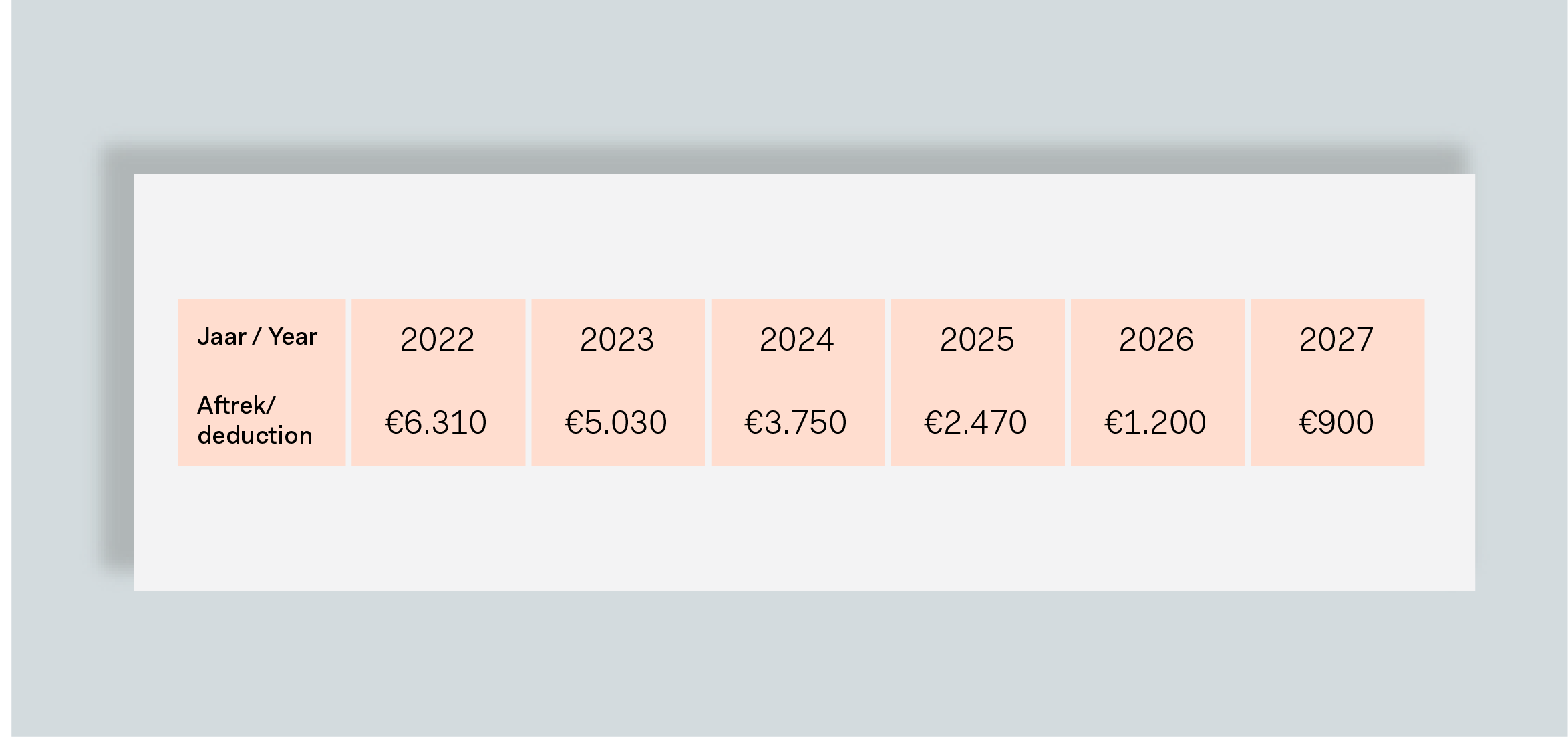

The phasing out of the private business ownership allowance has already been set into motion in previous years. In 2022, private business ownership allowance will still be € 6,310. From 2023, the Dutch government wants to further reduce this deductible item, to €1,200 in 2026 and lower it to €900 in 2027. Below schedule shows the steps per year:

Abolition of the fiscal retirement reserve (FOR)

The FOR is a scheme that allows entrepreneurs to build a pension by setting aside part of their profit. From 1 January 2023, entrepreneurs can no longer (continue to) build up their retirement reserve. The retirement reserve that has been built up up to and including 31 December 2022 will be settled according to the current rules.

Income tax goes down

In 2023, the government wants to reduce the tax on income from work up to €73,071 (box 1) from 37.07% to 36.93%. This will result in a maximum of €102 per year extra for workers.

General tax credit goes up

The general tax credit reduces the income tax for everyone with a job. The government is planning to increase the general tax credit annually from 1 January 2023. With this higher general tax credit, workers would benefit by €500 annually from 2023. Both employees and the self-employed will benefit from this.

Abolish income-related combination tax credit (IACK)

The government is planning to abolish the IACK from 1 January 2025. This tax credit is intended to make combining a job and caring for children financially attractive for parents. In order to continue to encourage parents to combine work and the care for children, the childcare allowance will be adjusted in such a way that the IACK is no longer necessary. For the time being, the tax credit will remain in effect for parents with 1 or more children born before 1 January 2025.

Temporary legislation box 3

From 2026, a new system for tax box 3, in which the actual return on capital is taxed, will come into effect. The government will work with temporary legislation for the intervening years, which is based on the actual distribution of savings, investments and debts. For this, the Tax and Customs Administration uses return percentages that are close to the real percentages for savings, investments or loans. This way, personal savings and investments will be assessed more accurate.

Before the government is allowed to implement any of these plans, parliament (the Senate and House of Representatives) must assess and approve them. If parliament approves, the new plans will usually come into effect on 1 January of the following year.