Insights

Woohoo! From now on, our Scan & Recognize feature is available to all users of Founders. That means: less manual input, more time for projects, coffee, or me-time!

How does the feature work?

With the help of smart AI, we automatically fill in as many details as possible when you upload a receipt or invoice. That saves you a lot of typing. Do keep in mind: you’re always the boss of your own bookkeeping, so double-check everything before finalizing your numbers!

How do I use Scan & Recognize?

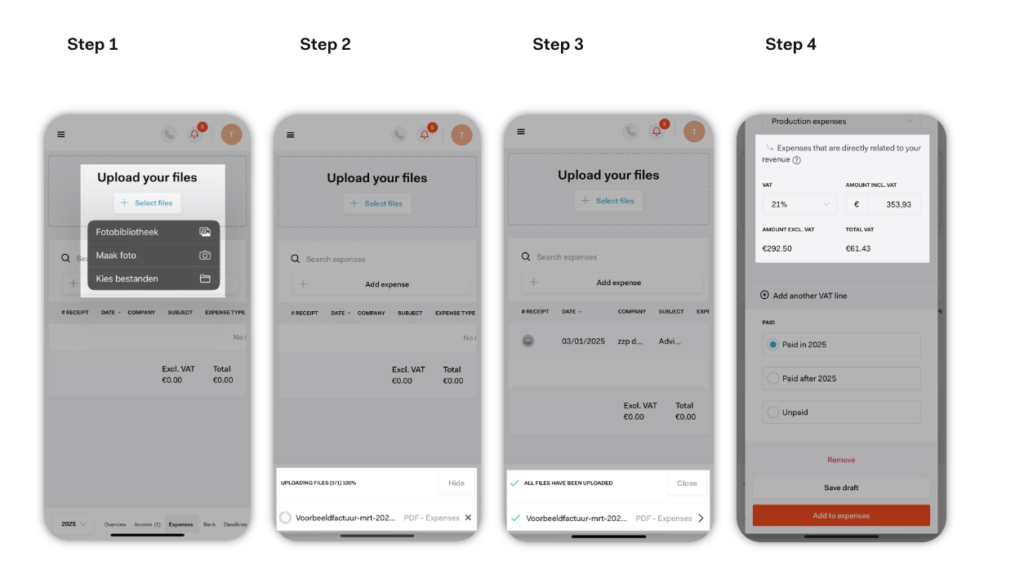

- Step 1: In our bookkeeping platform, go to your administration and click on ‘Upload your files’.

- Step 2: Add your receipt or invoice.

- Step 3: Voilà! You’ll get a draft booking with pre-filled details.

- Step 4: Check, check, double check that everything’s correct, and add it to your administration. That’s it!

Still prefer entering everything yourself? Totally fine! You can deactivate the Scan & Recognize feature. In our bookkeeping platform, go to Business → Settings → Scan & Recognize → untick the box.

What’s next?

We’re continuously improving the feature to make the results even more accurate and consistent. Got suggestions, feedback, or questions? Let us know at support@founders.nl.

Happy bookkeeping!